Profit Fix #5: Got Accounts On Credit Hold? Collection Agency Chasing Down Unpaid Bills?

How many invoices are being sent to collections by mistake?

How many of those result in a credit hold?

What if I told you that 3 out of 4 of those cases could easily be avoided?

This article expands on Profit Fix #4 about slow invoices and is another game-changer for our partners when it comes to collections, client relations, and cash flow.

Here’s an unfortunately common scenario:

*Phone rings*

> CS Agent: “Hi, this is George from BestTechService, how can I help you?”

> Client: “Hi George, this is Matt from NiceFoodJoint. I need a technician to come ASAP to check our combi oven please.”

** CS agent checks CRM **

> CS Agent: “Hmmm, sorry, Matt, but I see here that you’re currently on credit hold.”

> Client: “I’m sorry? Why would we be on credit hold for?”

> CS Agent: “The invoice, No. 123653 from 40 days ago, is still unpaid sir.”

** Matt checks his bills **

> Client: “Hmm, George... We didn’t even receive that invoice. It’s not on file.”

> CS Agent: “Oh, again... I'm sorry for the confusion, then. But still, I’ll need to have this resolved by collections and approved by the district manager.”

> Client: “Wow… Really? Ok, you guys do you, but my combi oven can’t wait until then, you know? I’ll call someone else!”

This may sound like an

outlier scenario, but if you’re processing hundreds, or even thousands, of work

orders a day, you know that it’s more common than we’d like it to be. And this

is costing mid-market companies a small fortune!

Not only was the missed

work order for a couple of grand and is now in a competitor’s pocket, but now

that invoice will go to a third-party collection agency that will take 25

percent as their cut, make unfriendly calls, and ruin relationships with legal

threats.

And now, the district

manager will have to try to win the account back—that is, if they even get over

the embarrassment and pain of doing so.

A relationship that took

months or years to build, can be trashed in minutes...

… And statistics say

that an account on credit hold is probably not coming back anyway.

Boy... What a mess!

So why does this even

happen? And, most importantly, how can

it be solved?

We’ve seen it happen

mainly because of relying too much on automation, without enough human

supervision.

And this is how it

looks:

Most of the invoicing is

automatic these days, which is good. But a big disconnect might happen for

something as simple as:

- There was a change in

the accounts payable email address, on the client-side.

- The vendor didn’t

update the CRM with the proper email where to send the invoices.

- An invoice was sent to

this client.

- The CRM automatically

marked an invoice as “done” even though the client never got it.

- No one checked that

the client did get it.

- 40 days later the CRM

automatically marked the account as “credit hold”.

Technology and

automation are AMAZING, except for when they're not, right?

Now to the good part: how can this be solved?

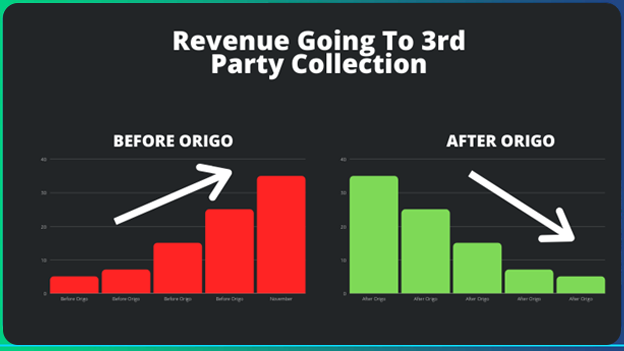

At Origo, we’ve deployed

a “revenue recovery” remote team for

one of our leading partners and reduced the collections being

handled by a third party by 75 percent!

Think about it, three

out of every four invoices that were previously going to an external collection

agency are now being handled internally—by their remote team—bringing forward

multiple six figures in cash flow for them every month.

And the other benefits

were HUGE.

Not only did we collect

MORE—because we’re picking up issues earlier when relationships are still on

the sweet side. So, there are no threats made, and no middle fingers being

thrown in the air. But also, there’s no “collection commission” either! Because

it’s not a collection service. It’s now part of their remote team’s day-to-day

operations.

Our partners now have a

dedicated remote team in place, with a process that actively watches their

accounts, the status of payments, and that proactively reaches out to their

clients, sorts due invoices, and solves disputes.

And client relationships

are not harmed. If anything it’s the opposite! Clients are taken better care of

and feel significant that there’s someone that follows up on things for them.

And when we take care of

all the standard invoicing for our clients:

- They have fewer

disputes and fewer third-party collections

- They have better cash

flow

- Their in-house billing

team is massively FREED UP to take care of the more custom and complex invoices

for key accounts

- Their billing managers

sleep better

- Their executives smile

more 🙂